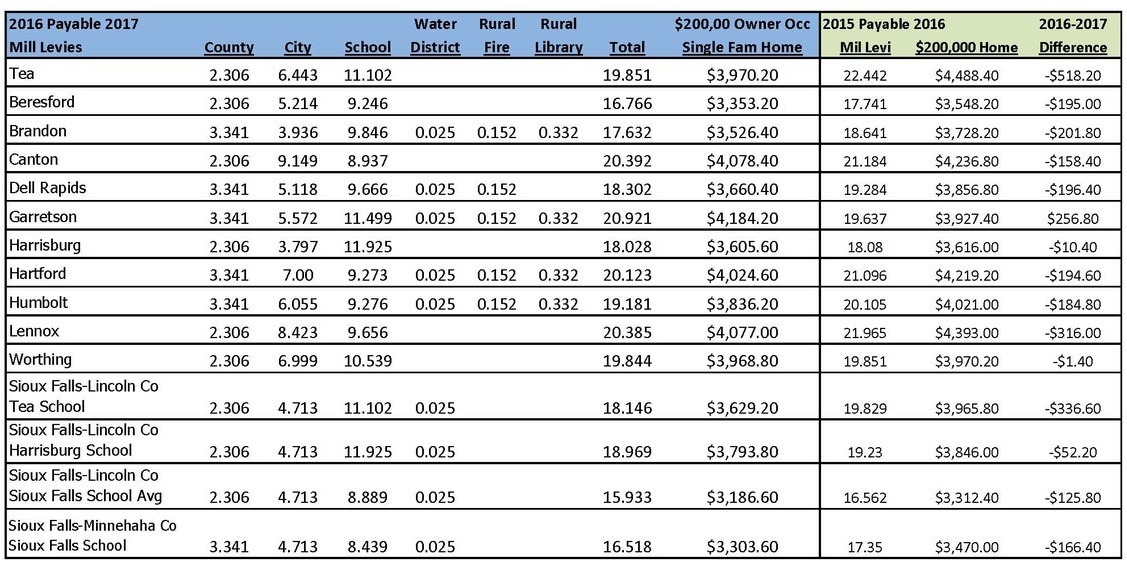

south dakota sales tax rates by county

Lowest sales tax 45. Municipalities may impose a general municipal sales tax rate of up to 2.

They may also impose a 1 municipal gross.

. The South Dakota state sales tax rate is currently. The Lake County sales tax rate is. The South Dakota state sales tax rate is currently.

Exact tax amount may vary for different items. All businesses licensed in South Dakota are also required to collect and remit municipal sales or use tax and the municipal gross receipts tax. Look up 2021 South Dakota sales tax rates in an easy to navigate table listed by county and city.

General Municipal Sales Tax. Some cities and local governments in Meade County collect additional local sales taxes which can be as high as 2. 366 rows 2022 List of South Dakota Local Sales Tax Rates.

For traditional business owners selling goods or services on site calculating sales tax is easy. The South Dakota state sales tax rate is currently. The South Dakota Department of Revenue administers these taxes.

The total sales tax rate in any given location can be broken down into state county city and special district rates. The 2018 United States Supreme Court decision in South Dakota v. The Brown County sales tax rate is.

Click on any county for detailed sales tax rates or see a. South Dakota has a 45 sales tax and Lake County collects an. The current state sales tax rate in South Dakota SD is 45 percent.

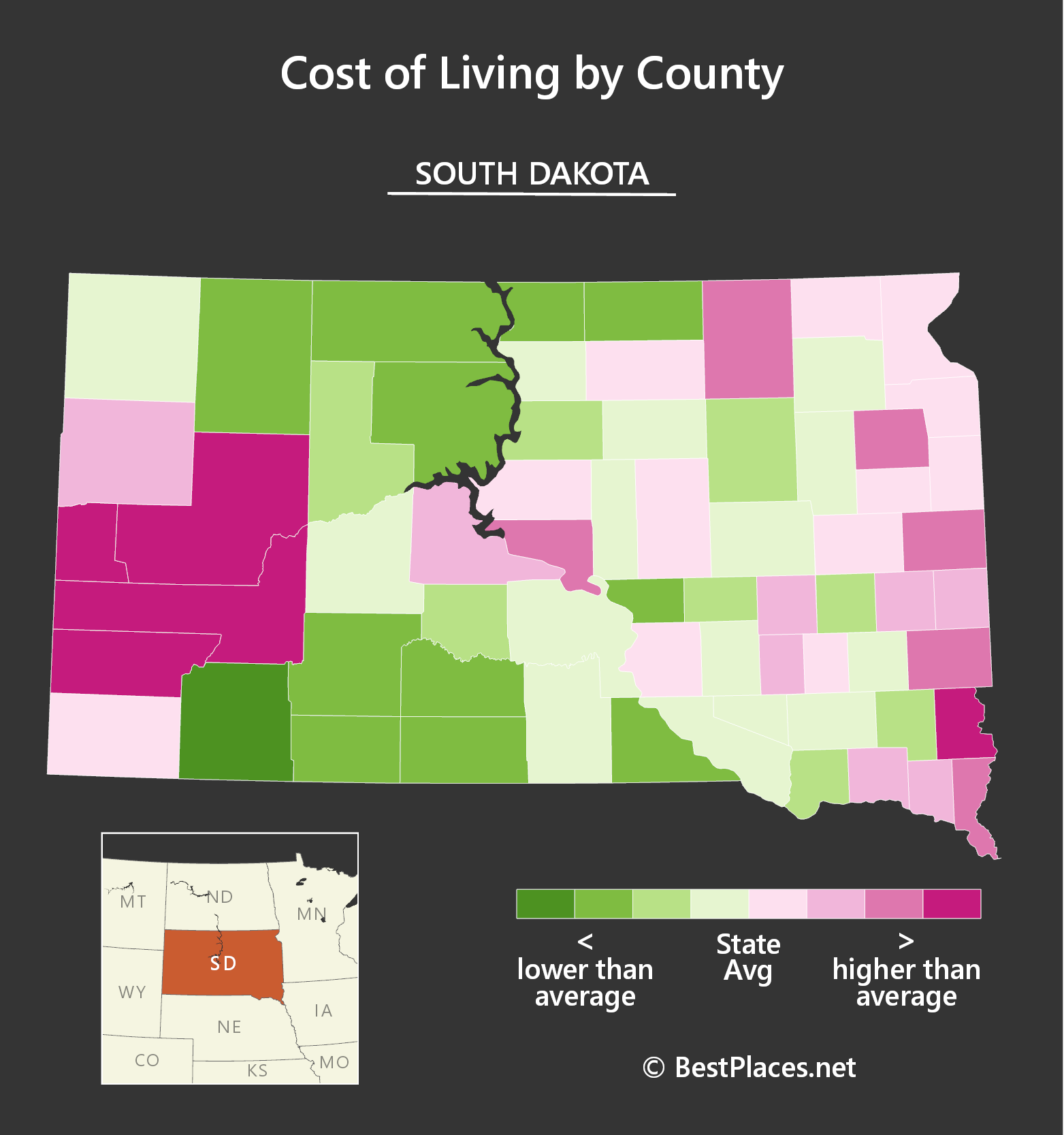

South Dakota has a 45 sales tax and Pennington County collects an. The total sales tax rate in any given location can be broken down into state county city and special district rates. This interactive sales tax map map of South Dakota shows how local sales tax rates vary across South Dakotas 66 counties.

The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services. This is the total of state and county sales tax rates. Our dataset includes all local sales tax jurisdictions in South Dakota at state county city and district levels.

With local taxes the total sales tax rate is between 4500 and 7500. One field heading that incorporates the term Date. The tax data is broken down by zip code and additional locality information.

Rate search goes back to 2005. 2022 South Dakota state sales tax. The base state sales tax rate in South Dakota is 45.

The total tax rate might be as high as 65 percent depending on local municipalities. Local tax rates in South Dakota range from 0 to 2 making the sales tax range in South Dakota 45 to 65. One field heading labeled Address2 used for additional address information.

Free sales tax calculator tool to estimate total amounts. The South Dakota sales tax of 45 applies countywide. The Fall River County sales tax rate is.

All sales are taxed at the rate based on the location of the storeThis includes South Dakotas. The 2018 United States Supreme Court decision in South Dakota v. The South Dakota state sales tax rate is currently.

The 2018 United States Supreme. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. This is the total of state and county sales tax rates.

The minimum combined 2022 sales tax rate for Turner County South Dakota is. South Dakota SD Sales Tax Rates by City all The state sales tax rate in South Dakota is 4500. South Dakota has 142 cities counties and special districts that collect a local sales tax in addition to the South Dakota state sales taxClick any locality for a full breakdown of local.

South Dakota Sales Tax Guide And Calculator 2022 Taxjar

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

Sales Use Tax South Dakota Department Of Revenue

Tax Information In Tea South Dakota City Of Tea

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

South Dakota Sales Tax Small Business Guide Truic

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

South Dakota Sales Tax Rates By City County 2022

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

Sales Use Tax South Dakota Department Of Revenue

Best Places To Live In Sioux Falls South Dakota

Sales Use Tax South Dakota Department Of Revenue

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

What Is Food Insecurity Feeding South Dakota

Sales Use Tax South Dakota Department Of Revenue

How To Start A Business In South Dakota A How To Start An Llc Small Business Guide