april 2016 service tax rate

If a new levy is introduced like Krishi Kalyan Cess or a service taxed for first time then Rule 5 is to be referred. 132016-ST dated 1-3-2016 effective from 14th May 2016.

Public Procurement National Action Plans On Business And Human Rights

Cenvat credit of input services are now available.

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

. From the 1st of June 2016 service tax is levied at 15 of the value of taxable services under Section 66 of the Service Tax Act. Simple Interest Rate. Thus abatement of 70 is presently available in respect of the said service.

The import customs duty rate on several types of almond dates and grapes will be decreased from 5 to 0 from 22 April 2016 to 31 May 2019 inclusive. 14 Swachh Bharat Cess 05 Krishi Kalyan Cess 05 the same will be applicable wef01-06-2016 after the enactment of Finance Bill. Swachh Bharat Cess 05 wef.

New Service Tax Chart with Service Tax Rate of 15. The government notification extract also is being updated in pdf format once after release from the authorities. 28 of 2016 the effective rate of Service Tax wef.

The Education Cess and Secondary and Higher Education Cess shall be subsumed in the revised rate of Service Tax. Changes in service tax Budget 2016. However if assessee has collected service tax but did not deposit it with Government interest rate will be 24 Notification No.

From April 2016 the new Personal Savings Allowance means that basic rate taxpayers will not have to pay tax on the first 1000 of savings income they receive and higher rate taxpayers will. Service tax rate increased from 145 to 15 increase by way of levying Krishi Kalyan Cess at 05. For the scenario till 31032016.

The service tax rate was increased from 1236 to 14 and the new rate subsumed a couple of cesses in the process. Cenvat credit on input input services and capital goods are not available. The Finance Bill 2015 proposes an increase in rate of Service Tax from 1236 to 14.

20 of 2015 the Central Government hereby appoints the 1st day of April 2016 as the date on which the provisions of sub-section 1 of section 109 of the said Act shall come into effect. INR 1000 INR 100 per day from 31st day subject to a maximum amount of Rs 20000. In exercise of the powers conferred by section 109 of the Finance Act 2015 No.

The 15 includes 05 Krishi Kalyan Cess and 05 Swach Bharat Cess. This new rate of Service Tax 14 was applicable from 1st June 2015. Service Tax has been replaced by the Goods and Services Tax GST starting 1 July 2017.

Awarded Global Tax and Legal Advisory Firm at Times Business Awards 2021. From 142016 service tax is leviable on 30 on amount charged for service of transport of passengers by rail without availability of cenvat credit of inputs and capital goods. The new effective service tax could henceforth be 15.

42 1430 435 14530 45 1530 Effective from 01042016 a uniform abatement at the rate of 70 is prescribed for services of construction of complex building civil structure or a part thereof subject to fulfillment of the existing conditions. Service Tax Interest Rates wef 14052016 Other than in above situations. Honble Finance Minister Sh.

8 rows April 2016-Sep 2016 April-May 145 July-Sep-15 Oct 2016-March 2017 Oct-March 15. While presenting the Budget 2015 the FM had increased the Service Tax Rate from 1236 to 14. The Said change will be effective from 1st June 2016.

Service Tax Basic Rate -14. Service Tax Rate. New Service Tax Rate effective from 01-06-2016 After enactment of the Finance Act 2016 No.

After levy of KKC. Krishi Kalyan Cess is proposed to be levied from 162016 05 on the value of such taxable services. 60 lakhs during any of the financial years covered by the notice or during the last.

Arun Jaitley tables the Union Budget 2016 on 29 Feb-2016 citing that 05 of Krishi Kalyan Cess to be levied on all the services making the effective service tax rate 15 ie. At present service tax is leviable on 30 of the value of service of transport of goods by vessel without Cenvat credit on inputs input services and capital goods. In case of small service providers whose value of taxable service did not exceed Rs.

18 rows 600. For the tax payers with value of taxable service less than 60 lakh rupees in PFY interest rate for delayed payment will be 12. You may also like to read Chapter V of Finance Act 1994.

Provided also that where the gross amount of service tax payable is nil the Central Excise officer may on being satisfied that there is sufficient reason for not filing the return reduce or waive the penalty. Penal Rate in case of tax collected but not deposited to exchequer. The service tax rate may get changed by Budget 2016 from 145 to 16.

The import customs duty rate on Brussels sprouts will be decreased from 13 to 5 from 22 April 2016 to 31 May 2019 inclusive. 16 rows Rate of Service tax would eventually increases to 15 wef. Budget 2016 has proposed to impose a Cess called the Krishi Kalyan Cess 05 on all taxable services.

The service tax rate changes for Promotion of Brand of Goods Services etc under Indian Budget 2017-18 is being updated below soon after announcement of Budget on 1 st February 2017. Simple Interest Rate 15 NOTIFICATION NO132016-ST DATED 1-3-2016 Service Tax Interest Rates on delayed payment of Service Tax in case of assessees whose value of taxable services in the preceding yearyears covered by the notice is less than Rs60 Lakh. The 15 includes 05 Krishi Kalyan Cess and 05 Swach Bharat Cess.

Important Changes in Service Tax in Budget 2015-2016. The Ministry of Finance increased the Service Tax rate in May 2015 and it was effective from June 2015. 01-06-2016 is increased from 1450 to 15 14 ST 050 Swachh Bharat Cess 050 Krishi Kalyan Cess by way of introducing Krishi Kalyan Cess 050 on value of taxable services.

Commentary On The 2017 2018 Financial Audits

Evaluation Of The Federal Tobacco Control Strategy 2012 2013 To 2015 2016 Canada Ca

Tax Principles Relx Information Based Analytics And Decision Tools

Consumer And Industrial Products And Services Publications

Interaction Of Household Income Consumption And Wealth Statistics On Taxation Statistics Explained

Pin On Inventory Management Software India

Why The U S Tax System Is So Complicated But Americans Are Proud To Pay Taxes Anyway The Washington Post

Pin By Pooja Bhatt On Gst India Goods And Services Tax Goods And Services Goods And Service Tax Indirect Tax

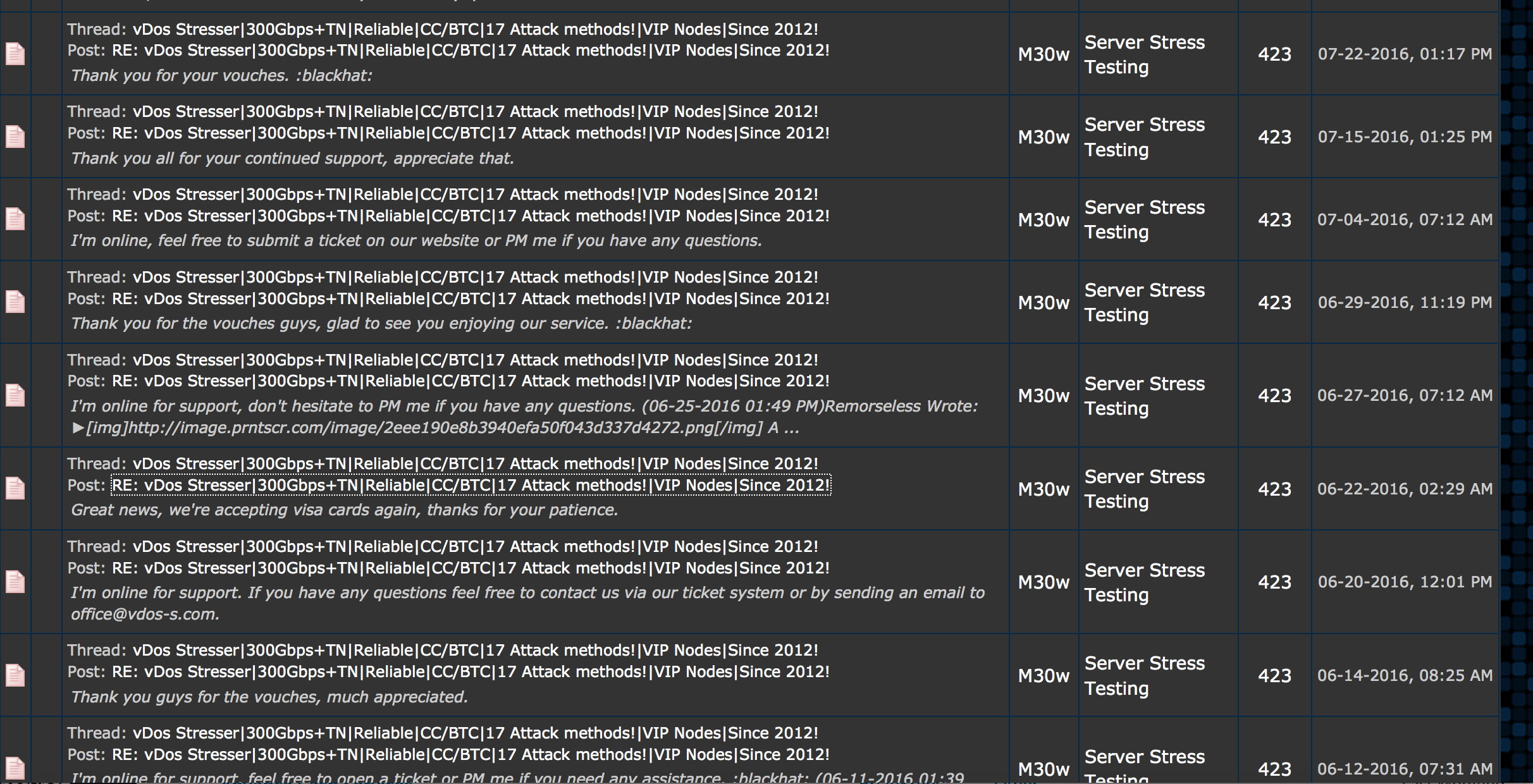

Israeli Online Attack Service Vdos Earned 600 000 In Two Years Krebs On Security

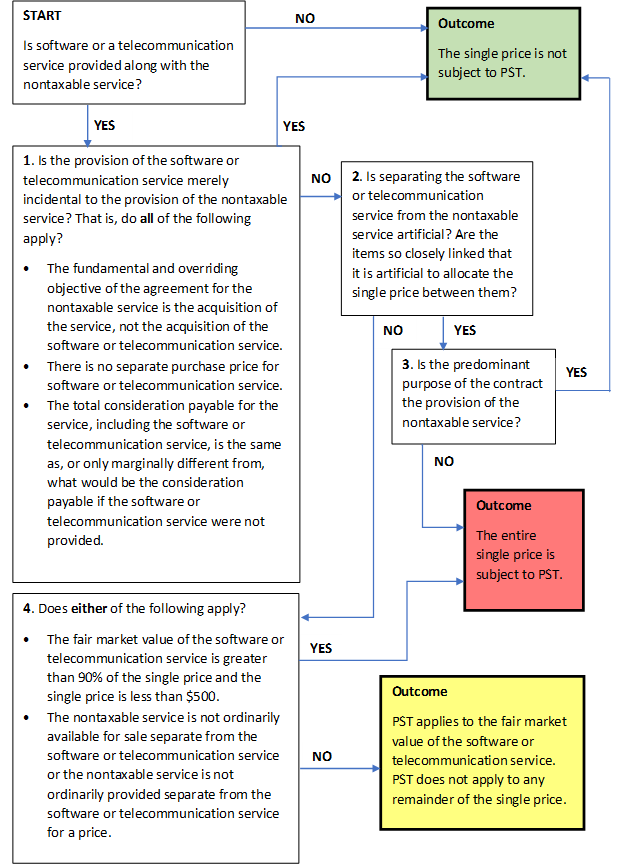

Tax Interpretation Manual Provincial Sales Tax Act General Rulings Province Of British Columbia

Brexit Definition British Exit From The European Union

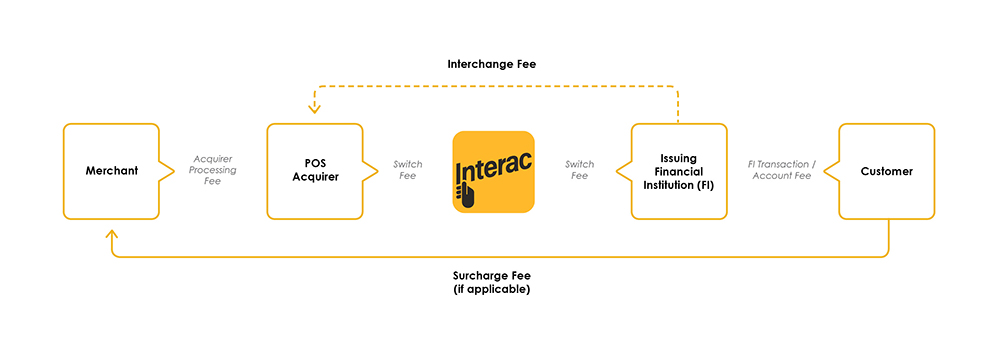

Learn About Our Solutions Fee Structure Business Interac

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

Pin By Lisapetbulous On Electric Scooter Business Singapore

Tds Due Date List April 2020 Accounting Software Due Date Dating

Pin By The Dermaco On All Saved In 2021 Goods And Service Tax Goods And Services Indirect Tax