salt tax deduction news

The IRSs clarification in 2020 that partnerships and S corporations may deduct their state and local tax SALT payments at the entity level in computing their nonseparately stated taxable income or loss was welcomed by taxpayers and their advisers. Prior to the Tax Cuts and Jobs Act TCJA you could deduct the full amount with no restrictions.

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

But what is the SALT cap.

. However nearly 20 states now offer a workaround that allows. Excluding an increase of the 10000 SALT deduction threatens to cause problems with several House Democrats whove said their support of any tax-code changes is contingent on raising the cap. Under the SALT Act people making less than 400000 would once again be permitted to deduct all state and local taxes on their federal income tax returns provided they itemize their.

12There has been a lot of discussion amongst government leaders about the cap on state and local tax SALT deductions. Nov 05 2021 at 1114 am. The State and Local Tax SALT deduction offers millions of Americans in high-tax states a federal tax break.

The deal which was included. The lawmakers have asked the US. Three House Democrats are still pushing for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT.

Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states like New York New. The state and local tax deduction cap set to expire at the end of 2025 limits the amount of state and local taxes that taxpayers can deduct from their federal taxes to 10000. Democrats consider SALT relief for state and local tax deductions One draft proposal floats 120 billion to lift the cap on state tax deductions for incomes up to about 400000.

52 rows The SALT deduction allows you to deduct your payments for. Congressional Democrats are negotiating changes to the 10000 cap on the federal deduction for state and local taxes known as SALT. After the limit became effective the SALT cost in lost federal revenue was lowered to an estimated 565 billion for FY 2019 and 589 billion for FY.

In theory a limit on a. Without a SALT cap workaround. In tax years 2018 to 2025 the SALT deduction is capped at 10000 for single taxpayers 10000 for married couples filing jointly and 5000 for married taxpayers filing.

The PorterMalinowski plan takes a middle path restoring the deduction for lesser affluent filers but keeping it in place for the rich. Are you paying an arm and a leg in state and local tax SALT payments. Democrats have forged a compromise to partially lift the so-called SALT tax deduction cap that hit the New York metro area particularly hard.

And how would a potential raise of the cap affect West Virginians. The Biden Administrations Build Back Better Act proposes raising the cap currently set at 10 000 to 80 000. This may be partially because the Tax Cuts and Jobs Act the same law that limited the SALT deduction to 10000 nearly doubled the standard deduction from 6500 to 12000 for individual.

While the 10000 ceiling on the SALT deduction is set to expire at the end of 2025 under the TCJA Malinowski and Porter hope to reform the tax code before that happens. WASHINGTON The Internal Revenue Service today clarified the tax treatment of state and local tax refunds arising from any year in which the new limit on the state and local tax SALT deduction is in effect. But in the 2 trillion tax cut law the GOP-run Congress passed in 2017 the SALT deduction was limited to 10000.

In Revenue Ruling 2019-11 PDF posted today on IRSgov the IRS provided four examples illustrating how the long-standing tax benefit rule. Department of the. Joe deducts 35000 of the S-Corp state taxes from his gross income saving 12950 in federal taxes 35000 state tax deduction x 37 top marginal federal tax rate.

Today the deduction is capped at 10000 but as recently as 2017. Some Dems Say Yes. A Democratic proposal aims to restore the SALT deduction for taxpayers who make less than 400000 a year and increase the deduction cap for Americans who make up to.

The Impact Of Eliminating The State And Local Tax Deduction Report

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

This Bill Could Give You A 60 000 Tax Deduction

Legislation Introduced In U S House To Restore The Salt Deduction

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

U S Lawmakers Pepper Congress With Pleas For Salt Tax Break Florida Phoenix

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

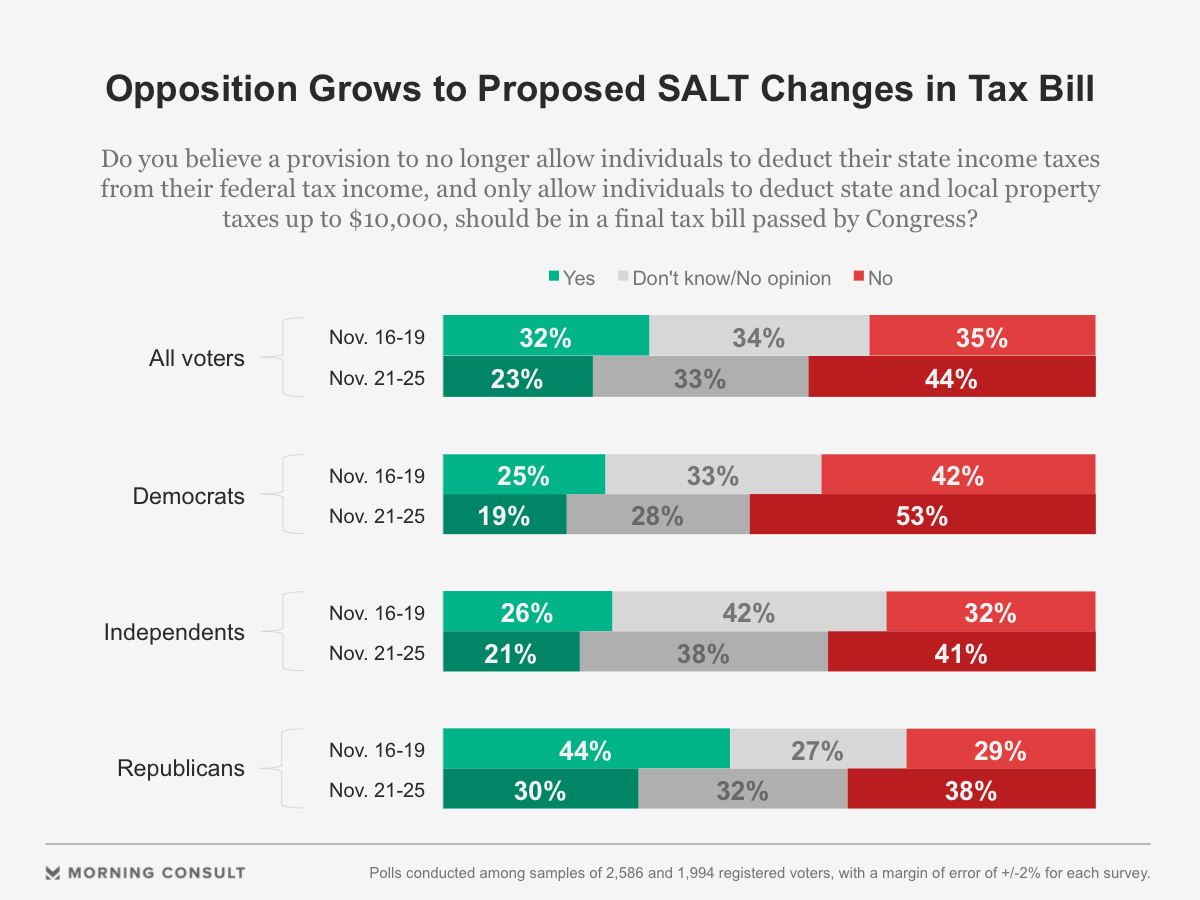

Voters Increasingly Oppose Proposed Salt Deduction Changes

Coping With The Salt Tax Deduction Cap

U S Rep Brad Schneider Named To Ways Means Vows Salt Deduction Battle Deduction Battle Vows

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

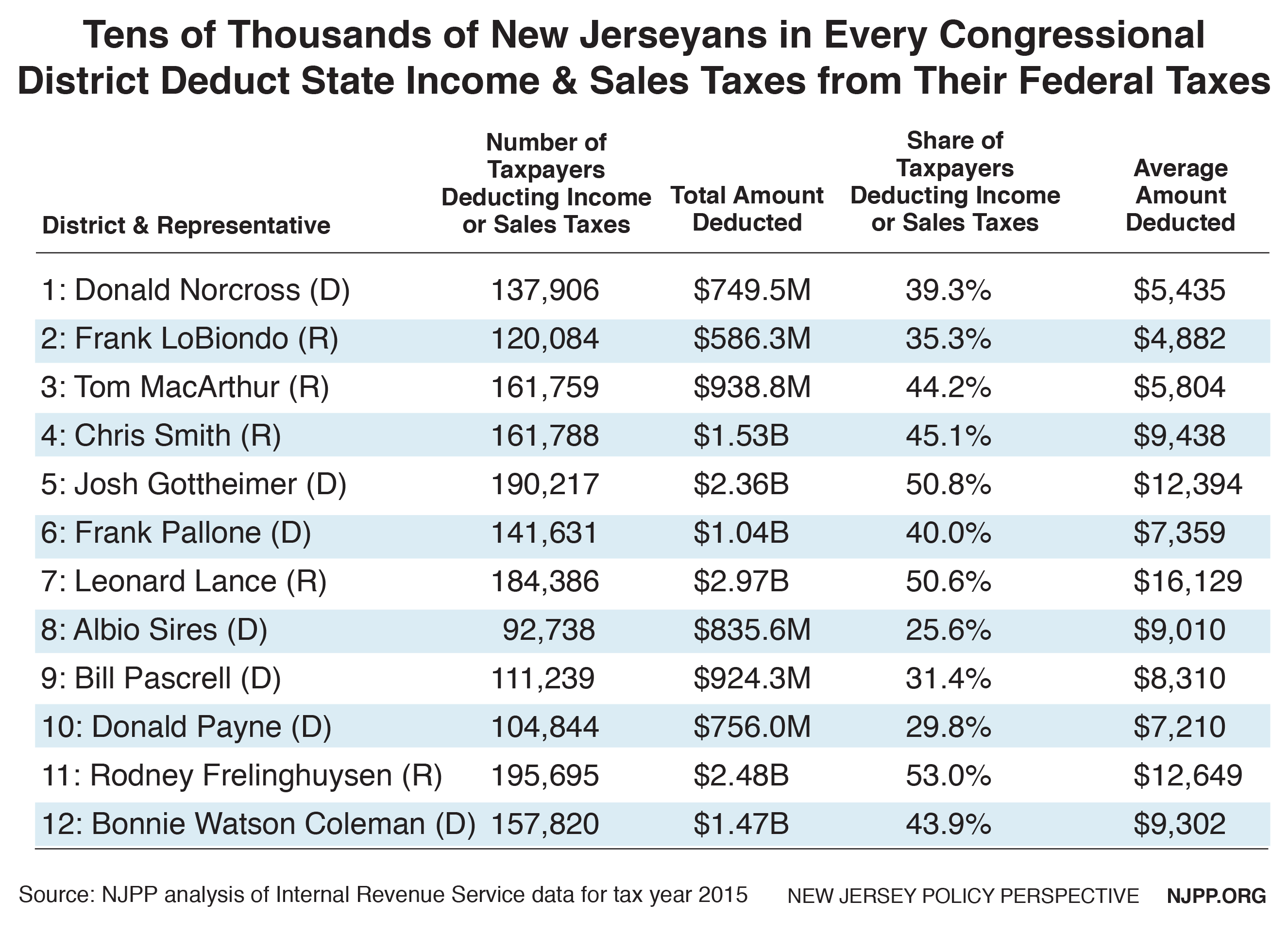

State And Local Tax Deductions Benefit Tens Of Thousands Of New Jerseyans Of All Incomes In Every Congressional District New Jersey Policy Perspective

Left Wants To Give Wealthy Constituents Bigger Salt Deduction

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

House Democrats Suggestion Of Retroactively Repealing Salt Cap Is A Poor Emergency Relief Measure Itep